Want to Vote for a $2 Billion Tax Increase For You and Your Neighbors?

Proposal 1 is an ugly sandwich. If you want to grow our government and feel like you're doing something for the roads, kids, or public transportation , this is for you. If you want to keep your money and not have the government take even more away without any reforms, this is not for you. Here are the facts courtesy of The Mackinac Center for Public Policy.

Proposal 1 would raise taxes $2 billion

On May 5, Michigan residents will vote on a constitutional amendment and a package of bills that will go into effect if approved. Proposal 1 would increase the sales tax from 6 to 7 percent, raise the fuel tax and increase vehicle registration taxes, among other things. It will also hike the state’s Earned Income Tax Credit.

Overall, the proposal will increase state taxes and spending by $2 billion in 2016, of which about $1.3 billion will go to funding public roads. Of the additional $700 million in new tax revenue, $300 million would go to public schools, $100 million to local government revenue sharing, and pledges for future spending on local bus and transit agencies. The increase in the EITC will cost the state budget a further $260 million.

Based on data from the U.S. Census Bureau, Department of Transportation and Bureau of Labor Statistics, Proposal 1 would increase the tax burden of the typical Michigan household by between $477 and $525 in 2016.

Part of this increased tax burden would come from paying more taxes at the pump. The federal Energy Information Administration projects the average price of gasoline to be $2.39 per gallon in 2015. At this rate, taxpayers would pay an extra 10 cents per gallon in taxes under Proposal 1, a 4 percent increase.

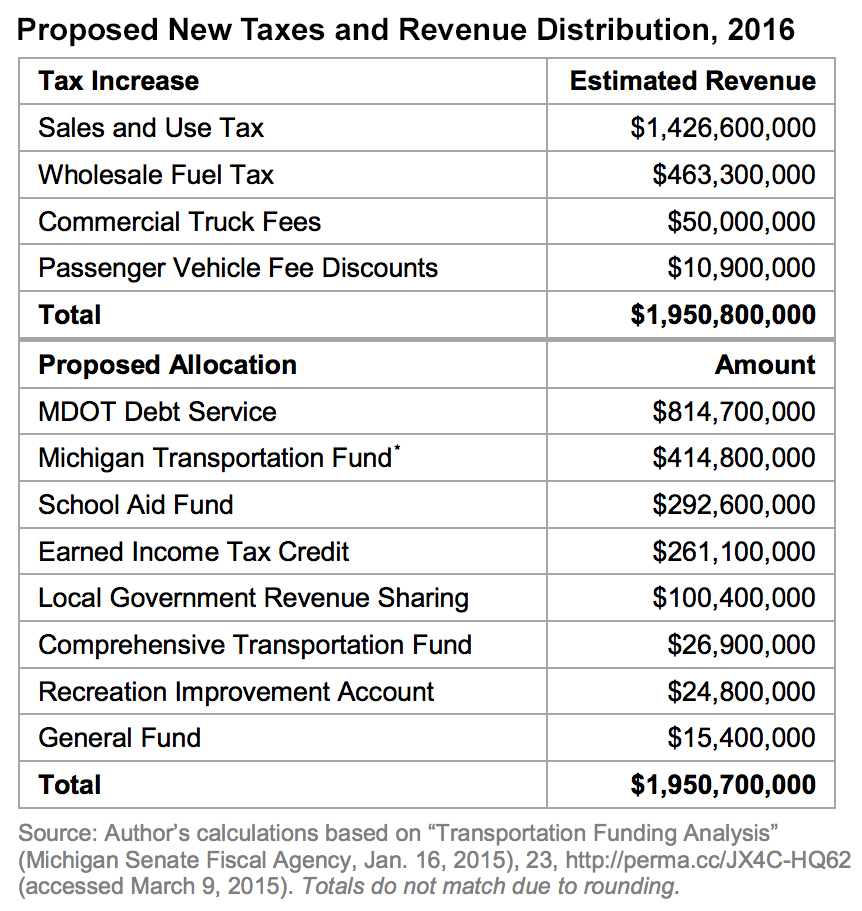

A breakdown of the proposed $2 billion tax increase follows below.

Tax and fee changes:

![]()

The proposal raises the state’s sales and use taxes from 6 percent to 7 percent, a 17 percent increase in the rate. This would give Michigan the second-highest state sales tax in the nation, though other states allow local governments to also levy their own sales taxes. Increasing sales and use tax rates would bring the state government an extra $1.4 billion.

![]()

The state currently imposes both sales tax and a per-gallon excise tax on motor fuel. This excise tax along with vehicle license and registration fees are the primary source of revenue for the state’s road maintenance budget. Under the measure, sales ;tax would no longer be imposed on fuel and the motor fuel tax would be replaced with a new wholesale tax levied at higher rates than currently.

At a listed price of $2 per gallon, the state is currently collecting 29 cents per gallon in sales and excise taxes on gasoline. This proposal would increase those collections to 41.7 cents per gallon.

![]()

Registration fees for commercial trucks that weigh more than 26,000 pounds will be increased on a sliding scale based on the truck’s weight.

![]()

Currently, the state provides relief from registration taxes as vehicles age. The annual tax is originally based on on the vehicle’s list price but is discounted at the first, second and third renewals. This package phases out these discounts on newer vehicles. Electric vehicles will also be subject to higher registration fees.

The change is not expected to raise much revenue in the first few years but will eventually collect $150 million annually when discounts no longer apply.

The table below shows how much each tax increase will generate and where this new revenue will be spent.

Ballot language:

A proposal to amend the State Constitution to increase the sales/use tax from 6% to 7% to replace and supplement reduced revenue to the School Aid Fund and local units of government caused by the elimination of the sales/use tax on gasoline and diesel fuel for vehicles operating on public roads, and to give effect to laws that provide additional money for roads and other transportation purposes by increasing the gas tax and vehicle registration fees. The proposed constitutional amendment would:

- Eliminate sales / use taxes on gasoline / diesel fuel for vehicles on public roads.

- Increase portion of use tax dedicated to School Aid Fund (SAF).

- Expand use of SAF to community colleges and career / technical education, and prohibit use for 4-year colleges / universities.

- Give effect to laws, including those that:

- Increase sales / use tax to 7%, as authorized by constitutional amendment.

- Increase gasoline / diesel fuel tax and adjust annually for inflation, increase vehicle registration fees, and dedicate revenue for roads and other transportation purposes.

- Expand competitive bidding and warranties for road projects.

- Increase earned income tax credit.

Tags:

Replies to This Discussion

-

Permalink Reply by XLFD on May 5, 2015 at 11:06am

-

Do you wonder how big media prepare you for this torturous tax increase? The City of Ludington Daily News (COLDNews) ran an article today from the Associated Press (AP) that is headlined "Michigan voters deciding on tax increase for road repairs". If that isn't subliminally suggesting you to vote for this, look at what's included in the article word-for-word, with translation for those who don't speak corporate media:

"Michigan is one of the most frugal of the states in spending on infrastructure such as highways." (Michigan leadership doesn't put enough of the ample public money it receives into infrastructure)

"It is supported by Republican Gov. Rick Snyder, both GOP and Democratic legislative leaders, business groups and organized labor. Supporters say it also would save on vehicle repair bills and boost economic development. Conservative opponents say the bipartisan measure unnecessarily includes more funding for education and local public safety as part of a political deal and should have been about fixing the roads only." (We think the only opponents of this are conservative wackos, who want to take more money from schools, film companies and other corporations, everyone else loves it).

They admit that over 2/3 oppose the bill, but give no idea why that's the case, other than a voter saying that it was transferring taxes more to poor folks than it was to corporations.

Meanwhile, our buddies at MCP also tip their hand subliminally as to whether they want more taxes (a "whether" between the words "voting" and "to" would work wonders for objective reportage):

-

Permalink Reply by XLFD on May 5, 2015 at 3:54pm

-

I went to the polls at city hall this afternoon, Third Ward Councilor Les Johnson was right in front of me casting his vote (anybody believe that he didn't vote "yes", it's more mad money for him and his cohorts).

I had a big red "N" on the back of my left hand and a big red "O" on the back of my right to remind me which way to go. Yet, the pollsters didn't throw me out for issue advocacy, since all they would read from their angle is "ON". The vote is "ON", and I'm only sorry I can't like MED's resoundancy.

-

Permalink Reply by Willy on May 5, 2015 at 4:01pm

-

Because of the way the proposal was worded, we're all going to find out in the news tomorrow that a no vote was actually a yes vote. "NO" I don't want to stop an increase in the sales tax.

-

Permalink Reply by XLFD on May 5, 2015 at 10:22pm

-

According to the Detroit Free Press, the proposal has been soundly defeated. "Proposal 1, likely one of the most complicated and confusing questions ever placed on a Michigan ballot, was soundly rejected Tuesday as many voters expressed anger at lawmakers and state government for failing to come up with a better solution to the sorry state of the roads.

The Free Press called the election for the no side less than one hour after the polls closed, based on analysis of exit poll results and early returns showing the no side winning by 4-1 margins in many parts of the state."

-

Permalink Reply by XLFD on May 6, 2015 at 8:34am

-

This was a loss of epic proportions for those Republicans in name only that sent us this complex tax increase that unfairly hit the poor and working classes the hardest. It's looking as if it's a 4-1 vote against, likely to be the most lopsided loss for a proposal ever in Michigan.

http://www.mlive.com/lansing-news/index.ssf/2015/05/michigan_voters...

BTW, in case you were wondering, over 85% of our state representatives voted to put this measure up for a vote by the people, including local talents Darwin Booher and Goeff Hansen. Ray Franz opposed it in the State Senate, but over 2/3 of his colleagues liked it.

This shows the dichotomy in today's age of our representatives and the people-- they both want the money that they believe they earned. Note to legislators: look to other states that have better road systems with less money to work with for ways to reform the current Michigan problem. The many years of spending public money for corporations and adding inefficiency to state spending hasn't helped, but it will take real courageous leadership to reverse the trend. But there's nothing there.

-

Permalink Reply by Willy on May 6, 2015 at 10:26am

-

Michigan's 2015 budget is 53 billion dollars. It seems to me that if an extra billion is needed for road repair, shifting 2% of the that budget towards roads could easily be done. A 2% cut across the board for all State expenditures would not be a cause for alarm and could easily be absorbed by all State agencies, Instead the idiots in Lansing tried to con us into raising our own taxes so they could spend it on pork barrel projects. Michigan's law makers are as useless as Washington's elected elite.

© 2025 Created by XLFD.

Powered by

![]()